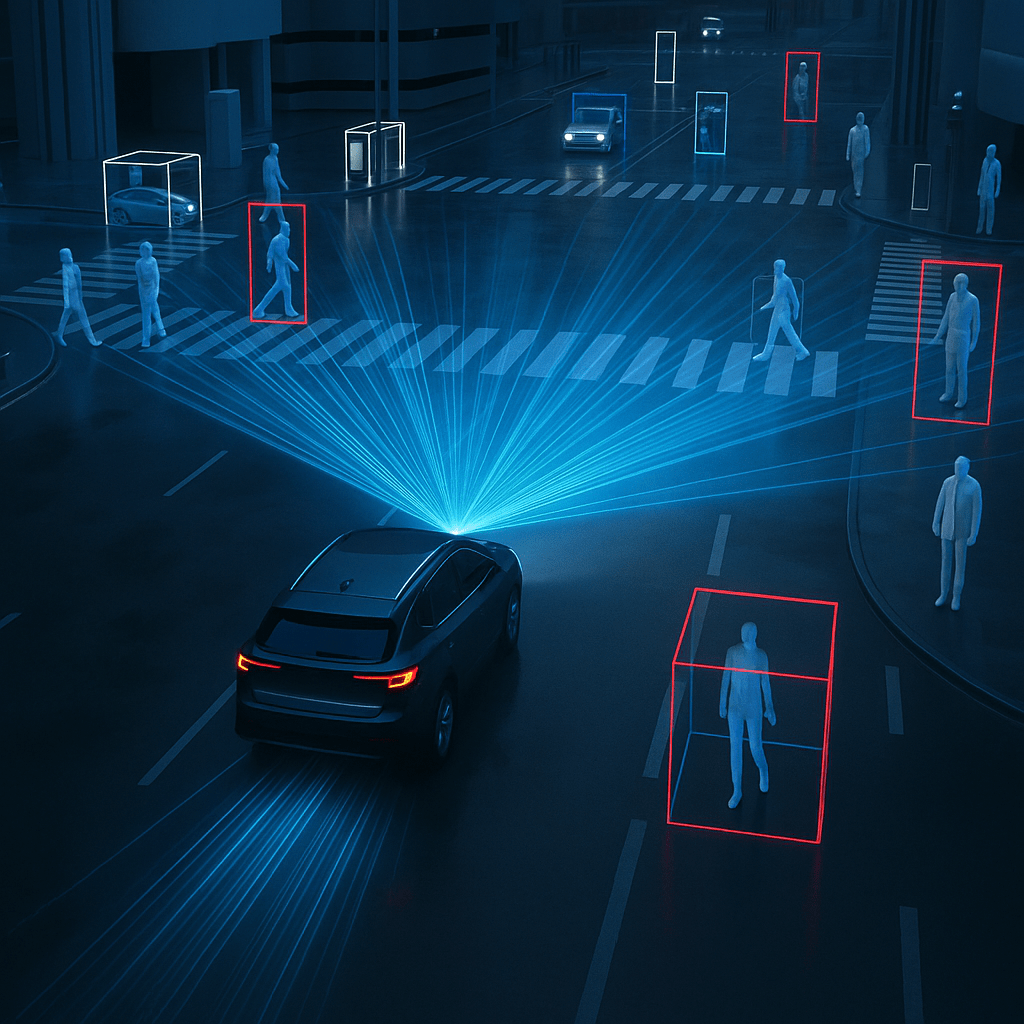

AEVA Technologies isn’t just another speculative tech play—it’s a company pioneering LiDAR sensors for autonomous vehicles, aiming to replace traditional radar and cameras with more precise, cost-effective solutions. In plain terms: they’re building the eyes of tomorrow’s self-driving cars. The stock? Priced like the future’s still stuck in traffic. But the technology? That’s the growth engine.

When I first bought AEVA on August 16, 2023, I purchased 20 shares at $5.393 each, totaling $107.86. This wasn’t a swing-for-the-fences bet; it was a calculated position based on growth potential. Sure, the company had no earnings yet—meaning no P/E ratio to speak of—and a price-to-sales (P/S) ratio around 12x, reflecting investor optimism ahead of results. The revenue pipeline looked promising if they could convert R&D into contracts.

Later that year, on November 21, 2023, I added another 20 shares at $2.85, for a total of $57.00. Not as a “double down” in the speculative sense, but rather as part of building the position with an eye toward eventual recovery. Still, here’s the nuance: the strategy I followed, the Double-Up Free Stock Strategy, isn’t about buying endlessly into dips. It’s about buying, selling enough to recoup the original capital, and holding the remainder as ‘free’ stock to ride potential upside.

By 2025, AEVA’s story shifted. After years of cautious partnerships and delayed industry timelines, they secured a multi-year contract with a Tier 1 supplier, sparking a sharp rally. From below $3, the stock surged above $9.

That’s where strategy met opportunity. On May 8, 2025, I placed a trailing stop sell order for 19 shares at a 10% threshold, meaning that if the price drops 10% from its highest point, the order will execute. As of now, with AEVA trading around $10.35, the stop would trigger a sale at $9.315 if the price falls. But importantly, the trade hasn’t triggered yet—it’s pending, designed to lock in gains while allowing further upside if the price keeps climbing.

The goal: sell enough to recover my initial investment while keeping the remaining shares to participate in future growth. This crystallizes the core of the strategy—recover capital, reduce downside, and leave upside potential intact.

This wasn’t a speculative exit; it was a structured move, grounded in valuation (P/S compressing as revenue expanded), improving fundamentals (new contracts), and technical discipline.

AEVA remains a high-risk growth stock in a volatile sector. But thanks to a predefined framework, I’m not left guessing. I’ve secured my principal position with a plan in place—and now, I’m letting the market work on the rest.

You can read more about this approach in detail at the official Double-Up Free Stock Strategy page.

Because in the end, smart investing isn’t just buying or selling—it’s knowing what to keep.

Leave a reply to deminvest Cancel reply