countertrend I read your new and your previous post, but I am not convinced.

Technically your deductions make sense, but they seem weak from macroeconomic point of view.

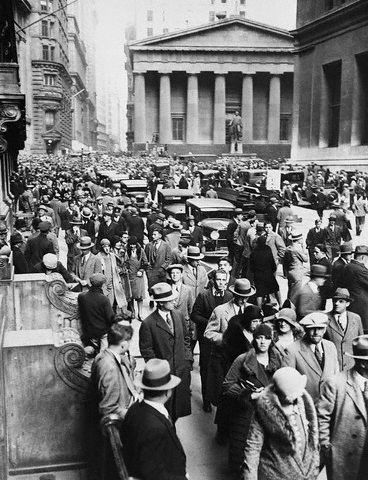

I do see a stock sell-off (… everybody unfortunately does), but I don’t see evidence of a global recession.

US economy is still growing at a good pace, rates are pretty low, companies are posting good earnings, inflation is under control.

Developing countries economies are growing extremely fast. Nobody really knows how to stop China and India. Europe economy, after years of modest growth, is now takin off, even with such high valued EURO.

Japan just came out of a long depression.

Yes there are US Twin deficits, yes the dollar is showing signs of weakness, but World Economy seems to me in good health and Wall Street is so large packed with global companies that in my opinion it could represent more global economy than US economy…

Yes there are less cars sold this year than last year… But more EBAY objects traded, Google searches performed, low cost trips booked on-line, and a little Robot called Roomba sold more one million units to clean houses all over the planet…

As I said I am not convinced, but I may be wrong.

Where you totally convince me… Is where you distrust GURUs writing that it is time to jump on bargains.

No No No… Let’s not jump on anything that may turn out to be a mine!

I am not selling stock nor buying looking for bargain. I will do what a simple investor can do in times of trouble: hide, wait and see… and hope you are wrong!

Leave a reply to Artic Cricket Cancel reply