Remember my Prospect for My December $1,500 Investment: ASE Technology Holding post from back in December? (Here it is if you missed it 👉 https://buysellkeep.com/2024/12/17/prospect-for-my-december-1500-investment-ase-technology-holding-co-ltd-ticker-asx/ )

Well, I didn’t put the whole $1,500 in (don’t ask — rookie mistake + double-order confusion), but I did end up with a fun little trade that turned into free shares faster than I expected.

📊 The Trade That Wasn’t Supposed to Be Dramatic

- 12/17/2024 — Bought 20 shares of ASX at $10.00 each

→ total cost: $200 - Today (2025-11-XX) — Sold 11 shares @ $18.4592

→ gross from sale: $203.05 (that’s math, not magic)

And now — drum roll, please — I also get to keep 9 free ASX shares thanks to the double-up / free stock strategy I originally wrote about with SoFi and other trades. Yuppy!!! 🎉

📌 Why I Bought It

If you read the original post, you’ll know the thesis wasn’t some drunken dartboard decision. I liked ASX because:

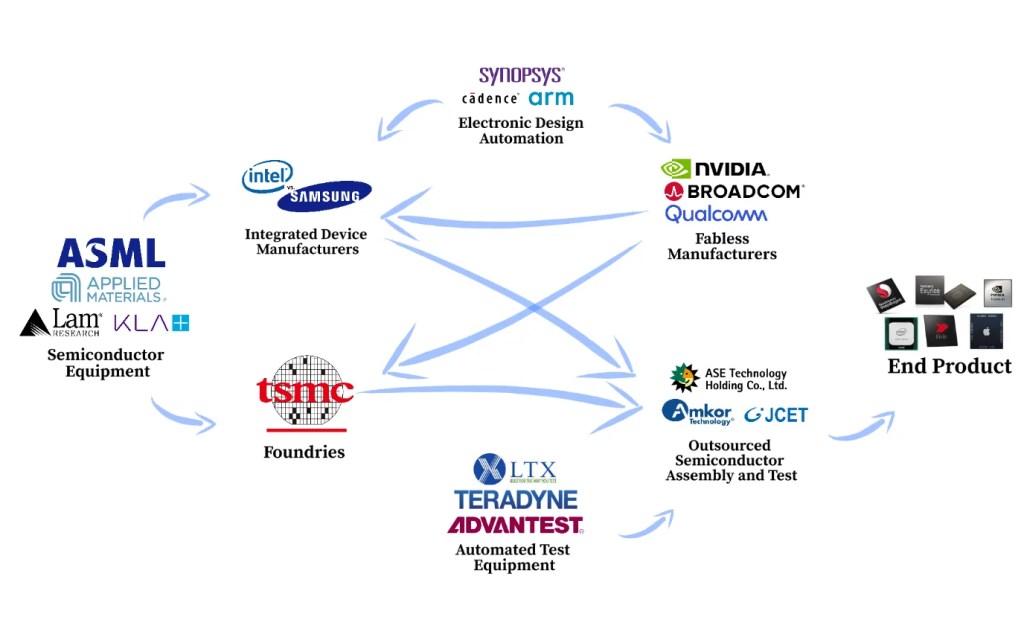

- It’s one of the world’s biggest semiconductor assembly and testing companies, not just another sleepy “ASX tech name.”

- Its price-to-sales looked reasonable compared to peers.

- It has technological relevance in an industry that feeds everything from phones to AI servers.

That mix of cheap valuation + real business + structural trend is like chocolate and peanut butter for value investors who are also a bit lazy. 😄

📉 Did the Fundamentals Match My Hype?

Let’s put some real numbers in here to see what the grown-up data says compared to my gut:

Valuation

- Trailing P/E is in the 30s and forward P/E closer to the mid-20s, which, given growth prospects, doesn’t look absurd in a tech context.

- Some analysts even point to ASX’s valuation being undervalued relative to peers, with a decent forward P/E and solid price/sales.

Growth & Industry Tailwinds

- The semiconductor packaging and testing business — ASX’s core — is expanding rapidly thanks to AI & computing demand. In fact, recent news shows ASE expects advanced packaging business to roughly double over the next couple of years as chip makers invest in capacity.

📊 Trade Summary & Stats

📅 Buy Date: 12/17/2024

Bought: 20 ASX shares at $10.00 → $200 invested

📅 Sold: 11 ASX shares (today) @ 18.4592 → ≈$203.05 back

🎁 Free Shares: 9 ASX shares received via double-up strategy — cost = $0

🧁 Free Share Value Today (approx): 9 × ~$18.3 ≈ $165+*

📈 ASE Technology Holding (ASX) Snapshot

| Metric | Value (approx) |

|---|---|

| Current Price (recent) | ~$18–19 per share |

| 52-Week Price Gain | +~93% |

| Market Cap | ~$41B+ |

| Trailing P/E Ratio | ~35–38x (varies by source) |

| Forward P/E Estimate | ~24–25x |

| Dividend Yield | ~1.4–1.7% |

| EPS (ttm) | ~0.25 USD |

| Sector | Semiconductors / Tech |

📌 What This All Means

- Price momentum: ASX has nearly doubled over 12 months, showing solid growth (especially for a stock you picked with a “lazy genius” plan).

- Valuation: The P/E ratio sits in the 30s, which isn’t rock-bottom cheap but also isn’t crazy expensive for a tech stock with good growth prospects.

- Forward expectations: Analysts see potential future earnings catching up to current price levels (lower forward P/E), which can be bullish if execution holds.

- Dividend: Some yield helps cushion downside — not huge, but a nice garnish.

- Free share value: Those 9 free shares now have real worth (which is the best kind of free). Even after selling your original cost back, you’re essentially playing with house money plus free equity.

🥳 Why This Was Actually Fun

Let’s be honest — the real joy here isn’t the $3 profit on paper (seriously, it’s peanuts). The fun is in the mechanics and the free shares:

- I bought a small position, totally reasonable for a learning experiment.

- The price moved nicely, and I got to recover my cost with sensible selling.

- Now I keep 9 free shares forever, like little digital souvenir tokens from the Market Gods.

For a $200 commitment, that’s like trading for gelato money and ending up with a dessert buffet.

💡 Lazy Genius Lessons

- Small money can still teach big lessons — you don’t need massive stakes to learn how a strategy unfolds.

- Value + trends beat just “hype alone” — ASX had both real business links to semiconductor growth and reasonable valuation.

- Free shares > paying shares — even if total value is modest, psychologically those free shares feel like a prize.

Now I’m sitting here with 9 shares that cost me zilch, pondering whether they might one day actually pay for something cool — or at least another gelato if I’m lucky. 😄

Leave a comment