Today’s Thoughts and Action: Why I’m Considering KGRN for My Monthly $1,500

Date: October 20, 2025

Ticker: KGRN (KraneShares MSCI China Clean Technology Index ETF)

My Monthly Investment Size: $1,500

If you’ve read my Double-Up Free Stock Strategy, you know I like to act small first, think big later.

Today’s focus: KGRN — the KraneShares MSCI China Clean Technology Index ETF.

I’m looking at it for my next monthly $1,500 investment because it sits at the intersection of five interesting realities: valuation, policy, cost, timing, and sentiment.

1️⃣ Far from the Top (Valuation & Sentiment)

KGRN launched in 2017 and currently holds ~52 companies in Chinese clean technology:

- XPeng (~8.7 %)

- Li Auto (~8.4 %)

- CATL (Contemporary Amperex Technology) (~8.1 %)

- BYD Co. (H) (~6.9 %)

- NIO (~6.4 %)

It trades around $30, up ~42 % YTD, yet still far below its 2021 highs near $40.

- 52-week range: $20.9 – $32.9

- Beta: 0.66 vs SPY

- Correlation: ~0.2 → a genuine diversifier

- P/E: ≈ 22 (“honest,” not hype)

- Dividend yield: ~1.7 %, paid semi-annually

So even after the rebound, I see it as early in the theme, not late in the mania.

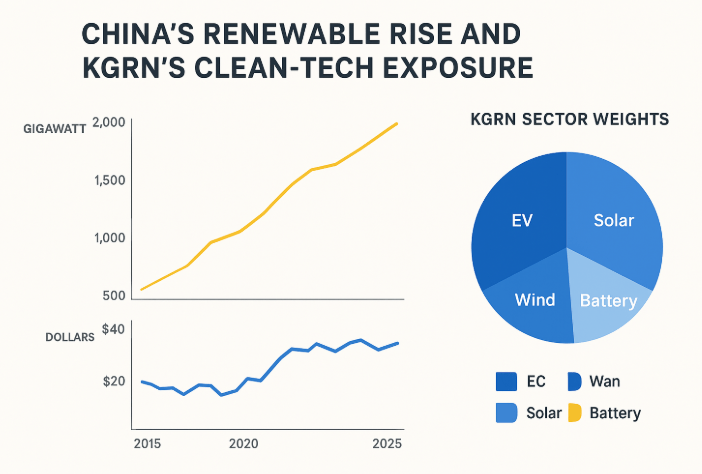

2️⃣ China’s Renewable Juggernaut

Now the macro side — and it’s stunning.

In 2024:

- 86 % of new Chinese power capacity was renewable. (Asian Power)

- Cumulative renewable capacity: 1.889 TW, up 25 % YoY.

- Solar 887 GW

- Wind 521 GW

- Hydro 436 GW

- Biomass 46 GW

- Renewables now represent 56 % of China’s installed power capacity. (English.gov.cn)

- Generation from renewables: 3.46 trillion kWh, +19 % YoY. (Redex.eco)

- By Q3 2024, China had installed 210 GW of new renewable capacity — 161 GW solar alone. (Renew Economy)

Global context:

Even with record growth, the world added ~582 GW of renewables in 2024 — still below what’s needed to hit 2030 climate goals. (Reuters)

💡 Translation:

KGRN sits right in the engine room of the fastest-growing clean-tech build-out on Earth.

3️⃣ Honest Fundamentals and Exposure Mix

KGRN tracks the MSCI China IMI Environment 10/40 Index, focusing on companies that earn ≥ 50 % of their revenue from environmentally beneficial products or services.

That means exposure to:

- Solar module and battery manufacturers

- EV & charging infrastructure firms

- Industrial efficiency tech

- Renewable utilities

And it comes with tangible metrics:

- Expense ratio 0.79 %

- Assets ≈ $60–65 M

- Dividend yield ~1.7 %

- P/E ≈ 22

For an emerging-market clean-tech ETF, those numbers are quite grounded.

4️⃣ The Price-Drop Paradox: Falling Solar Prices Are Good

Yes — overproduction is squeezing margins for panel makers.

But that’s temporary pain, long-term gain.

As prices fall, adoption explodes. Every household, factory, and grid operator starts asking:

“Why wouldn’t I buy solar when it’s this cheap?”

That’s when “too much supply” becomes “global dominance.”

China’s manufacturing scale ensures that when this flip happens, KGRN’s underlying companies are the suppliers to the world.

5️⃣ Relative Value: U.S. vs China

In 2025, the S&P 500 trades near record multiples (P/E > 23 on forward basis).

The NASDAQ 100 (QQQ) is even pricier, inflated by AI mania and stretched expectations.

China, by contrast, has suffered multi-year valuation compression — a classic setup where pessimism creates opportunity.

To me, this isn’t about “China good, U.S. bad.” It’s about balance.

KGRN gives me exposure to a theme that’s rising from a different base.

Cheap + growth + structural policy support = a rare trifecta.

🧭 My Plan of Action

- Wait for a red day.

I’ll buy my full $1,500 monthly tranche of KGRN on a down-market day.

That’s my built-in discipline — buy dips, not euphoria. - Start with a token.

As per my Double-Up Strategy:- Today I bought 4 shares KGRN @ $29.85 (≈ $119.40).

- Balance it with a hedge.

- Also shorted 100 QQQ @ $611.85 ($61,185) — because I believe the NASDAQ may need to breathe.

💡 This combo — long KGRN / short QQQ — gives me clean-tech upside and U.S. tech downside protection.

⚠️ Risks (No Rose-Tinted Glasses)

- China policy & regulation: unpredictable subsidies, export rules, or capital controls.

- ETF size & liquidity: small fund = wider spreads.

- Margin compression: oversupply of solar & battery products.

- Geopolitics: tariffs, sanctions, or supply-chain frictions.

- Short risk: QQQ can keep rising — short positions hurt.

- Timing: waiting for “down days” can miss uptrends.

🧩 Why It Still Makes Sense

KGRN offers:

- Thematic exposure to China’s decarbonization drive.

- Diversification away from U.S. tech concentration.

- A chance to ride the global clean-energy cost curve.

- Reasonable valuations with real growth drivers.

It’s the “underdog ETF” in a market full of expensive stars.

💬 Final Thought

I like KGRN because it’s both a bet on China’s industrial competence and a bet on the inevitability of cheap renewables.

I don’t expect it to soar every month — but over years, if the world keeps decarbonizing and China keeps producing, KGRN could quietly compound in the background.

So today: a token buy, a watchful eye, and patience for the next dip.

Leave a comment