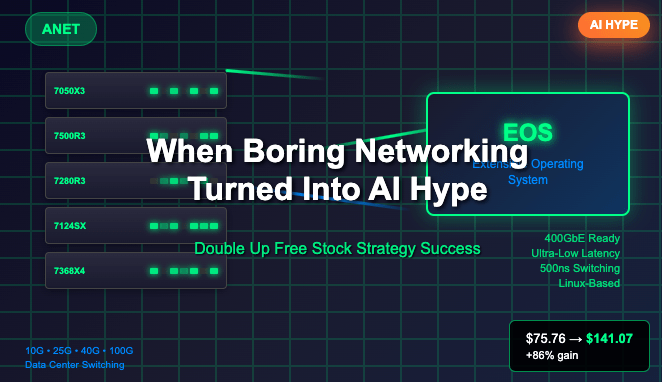

Used the Double Up Free Stock Strategy on Arista Networks. Here’s what happened.

The Trade

May 31, 2024: Bought 2 shares of ANET at $75.765 each = $151.53 total

September 12, 2025: Sold 1 share at $141.0656 = $141.07 recovered

Math: Got back $141.07 of my original $151.53, leaving $10.46 at risk. Still own 1 share worth $141.07 that’s basically free now.

Why ANET Made Sense (In Hindsight)

Everyone was going crazy about AI chips while I figured someone had to connect all those processors together. Turns out datacenter networking was actually important. Who knew.

The fundamentals looked decent:

- Revenue growing consistently (hit $7B in 2024)

- Market leader in datacenter switching

- Their EOS software gives them an edge

- AI infrastructure needs fast networking

The AI angle: Training massive AI models requires really fast connections between servers. Arista builds exactly that kind of equipment. Pretty straightforward thesis.

The Waiting Part

Had to wait over a year for this to work out. Almost sold at 30% up but the strategy forced me to wait for the double. Good thing since it took 15 months to get there.

Why The Strategy Worked Here

The Double Up Free Stock Strategy fit well because:

- ANET had growth potential from AI infrastructure demand

- Stock went from $75.76 to $141.07 (86% gain)

- Selling half protected most of my capital while keeping exposure

What I Learned

- Infrastructure plays can work if you pick the right companies

- Sometimes boring equipment companies outperform flashy tech

- Having a systematic approach helps avoid emotional selling

- My remaining share is essentially risk-free now

The Double Up Free Stock Strategy keeps proving useful for growth stocks with solid fundamentals. Key is finding companies positioned for multi-year trends and having the patience to let it play out.

More details on the strategy: BuySellKeep.com

Disclaimer: Not financial advice. Do your own research before investing.

Leave a comment