Back in November 2023, when the market was still arguing about whether tech stocks had any gas left in the tank, I quietly picked up 0.49866794 shares of CrowdStrike (CRWD) for $114.18.

Why CrowdStrike? Because if you squinted past the macro noise, you could see a company doing everything right. It wasn’t just “cybersecurity”—it was cloud-native, AI-driven, and more importantly, actually profitable. While the rest of the growth darlings were still recovering from their zero-interest-rate hangovers, CRWD was posting real earnings, growing free cash flow, and quietly expanding its moat.

So I bought a fractional slice—nothing flashy, just a toehold.

Then I waited.

Fast forward to May 27, 2025. CrowdStrike’s stock had done what good stocks tend to do over time: it went up. Not in a straight line, and not without giving bears a few reasons to feel smug along the way—but up nonetheless.

At that point, I sold exactly 0.234140936 shares, bringing in… $114.18.

Same amount I put in, now back in my pocket. But here’s the fun part:

I still own 0.264527004 shares of CRWD.

That’s right—I now hold a quarter of a CRWD share with a cost basis of zero. The rest of my original stake paid for itself.

No options, no leverage, no complicated trade structuring. Just a little patience, and a spreadsheet with a calculator function.

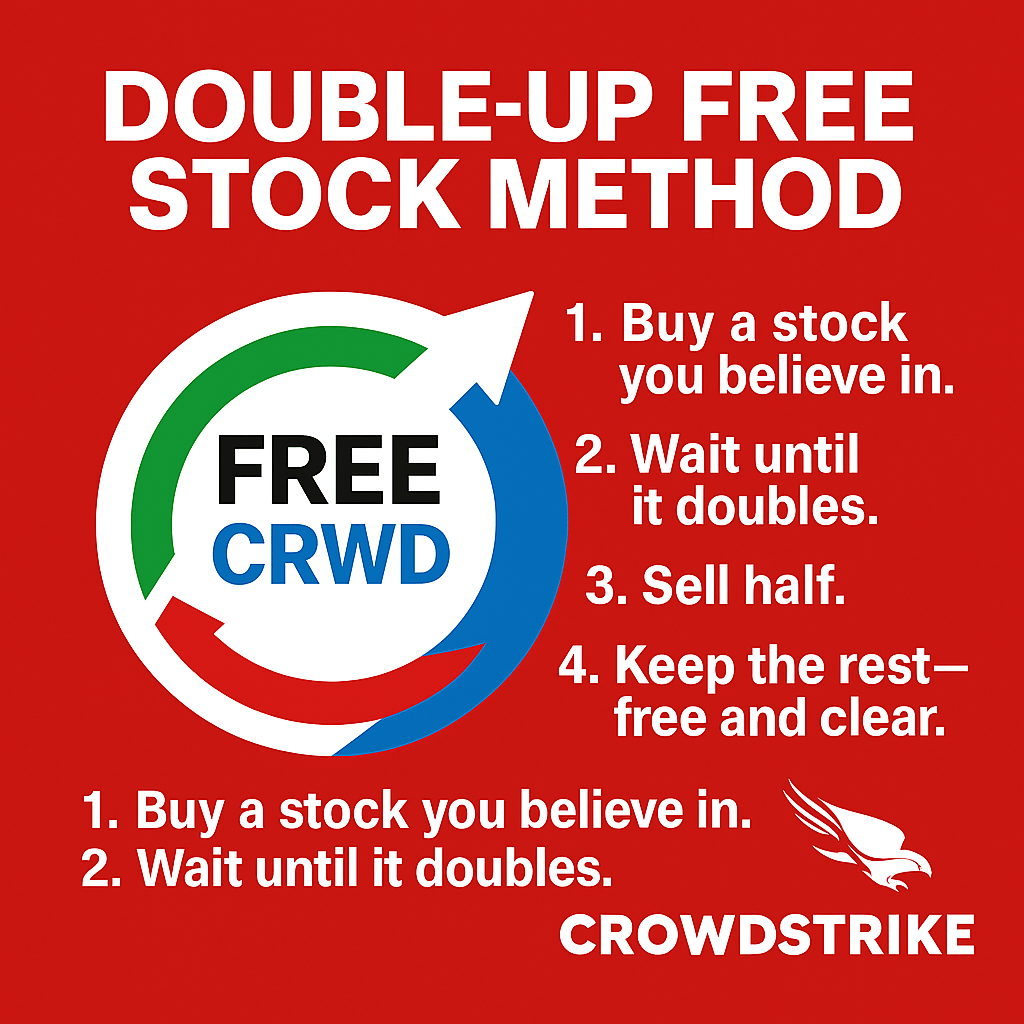

The strategy? I call it the Double-Up Free Stock method.

- Buy a stock you believe in, ideally while it’s unloved.

- Wait until it doubles.

- Sell half.

- Keep the rest—free and clear.

Now I have “free” CRWD shares sitting quietly in my portfolio, compounding away. Maybe they’ll triple. Maybe they’ll get acquired. Maybe they’ll just sit there, spinning off alpha-flavored good vibes. Either way, they owe me nothing.

And that’s a position I’m always happy to hold.

Leave a comment