- he Hope Trade

Bought 30 shares of WBX at $12.01, investing $360.30 in what I thought was a promising EV play. - The Disaster

WBX nosedives — down 88%. Hope turns to horror. - The Throwing-Good-Money-After-Bad Trade

I double down (sort of): bought another 30 shares at $1.38, spending just $42.40, because “it can’t fall much more,” right? - The -9 7% Moment of Clarity

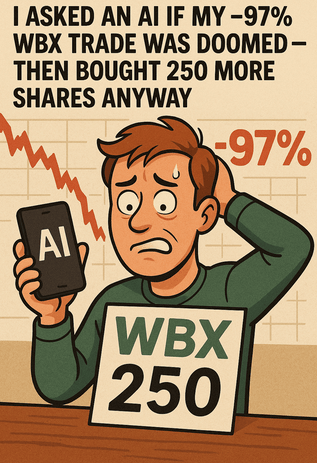

Today, I check my portfolio and it’s deep in the red. My total WBX position is down a staggering 97%. I ask an AI if this company — or what’s left of it — is doomed. Here’s the reply. - The Bargaining Delusion (a.k.a. “Hopefully My Last Dumb Buy”)

I YOLO 250 more shares at $0.3376, tossing in another $84.40, clinging to a cocktail of desperation and “maybe AI knows something I don’t.”

So… Is WBX Doomed? Here’s What the AI Said

Wallbox N.V. (NYSE: WBX), known for its EV charging and energy management tech, has taken a beating — the stock is trading around $0.355, a 98% drop from its all-time high. But is it completely hopeless?

📉 Stock Performance

- Current price: $0.355

- Off ~98% from the peak

- Market sentiment: brutal

📊 Q1 2025 Financial Highlights

- Revenue: €37.6 million (beat expectations)

- Gross margin: 38.1% — up over 6% from last quarter

- Adjusted EBITDA improved 42% YoY — their best since going public

- North American sales +142% YoY, which helped offset weak EU numbers

📈 Analyst Outlook

- Analysts aren’t bullish — but they’re not pulling the plug either

- Price targets range from $0.50 to $1.00, with a median of $0.75

- That’s more than 100% upside from where it sits today — if you believe it

🤝 Strategic Moves

- Partnered with Nissan Canada for a nationwide home EV charging program

- Teaming up with TotalEnergies in Belgium for a pilot

- These are solid moves — IF they turn into revenue

The Verdict

Wallbox isn’t exactly thriving — but it’s not flatlining either. While Europe is struggling, North America is a bright spot. Financials are improving, and strategic partnerships could lift it back into relevance.

So… is WBX doomed?

Not necessarily. But it’s skating on thin ice.

As for me? I’m in for 310 shares now. Call it conviction. Call it stubbornness. Call it a case study in how not to invest.

Or maybe — just maybe — it’ll be a hell of a comeback story.

Leave a comment