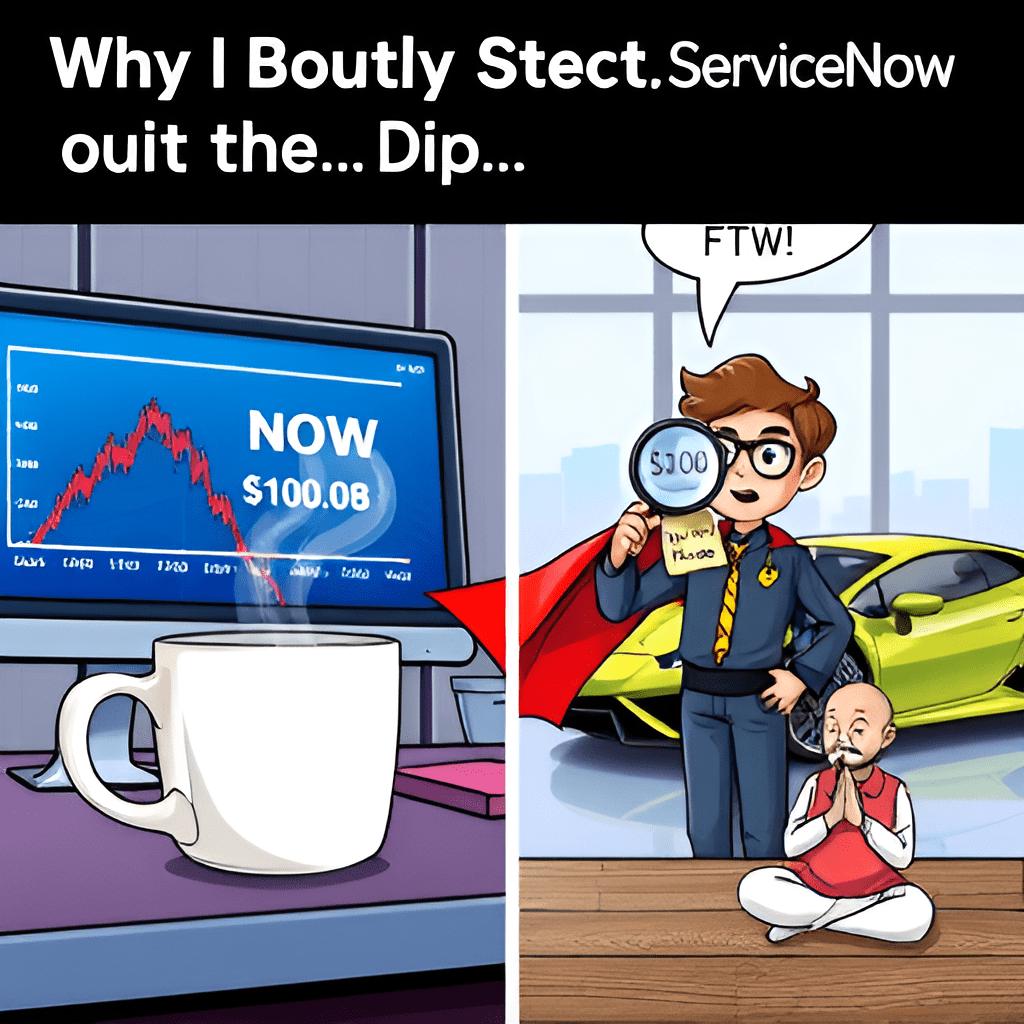

Let me set the scene for you: It’s January 30, 2025. The sun is shining, birds are chirping, and I, a self-proclaimed “bold investor,” am sitting at my desk, confidently executing a trade that will go down in history as… well, let’s call it a learning experience. I bought 0.1 shares of ServiceNow (NOW) at $1,000.80 per share. Yes, you read that right. Not 10 shares. Not 1 share. Zero point one shares. Because apparently, I thought I was Warren Buffett but with the budget of someone who still gets excited about finding a penny on the sidewalk.

Now, let’s talk about why this trade is the equivalent of buying a slightly dented Lamborghini—sure, it’s not perfect, but it’s still a Lamborghini.

The Setup: A Company on Sale (But Not in a Good Way… Yet)

ServiceNow, the software and IT services provider, had been on a tear. Over the past year, its stock had surged almost 50%. That’s right—50%. And what did I do? I saw that number and thought, “Wow, this train is moving fast. I should definitely jump on it!”

But then, the very next day, ServiceNow’s stock tanked 12.85%, dropping $146.94 per share. Why? Because the company posted slower subscription revenue growth than expected and projected a slight decline in first-quarter growth. In other words, the market decided to throw a little tantrum.

And what did I do? I bought the dip. Because here’s the thing: I’m an opportunist. I see a stock that’s down 12.85% and think, “Wow, that’s a discount!” I see a company with a trailing P/E of 178.14 and think, “That’s just the market being dramatic!” And I see quarterly revenue growth of 22.20% and think, “This is still a great company!”

So, I bought in. And by “bought in,” I mean I spent $100.08 on 0.1 shares. Because why not?

The Numbers: A Comedy of Ratios (But in a Good Way)

Let’s break down the financials, because nothing says “fun” like analyzing trailing P/E ratios and quarterly revenue growth.

- Trailing P/E: 178.14. Okay, that’s high. But hey, it’s a premium for a reason, right?

- Forward P/E: 68.03. Much more reasonable. And hey, maybe the market overreacted.

- Quarterly Revenue Growth: 22.20%. Still impressive, even if it’s slowing down a bit.

- Quarterly Earnings Growth: 78.50%. That’s not just growth—that’s explosive growth.

So, yeah, the stock dipped. But did I panic? Nope. Because I’m in it for the long haul. Or at least until I can afford a whole share.

The Free Stock Strategy: My Secret Sauce

If you’ve been following my blog, you know the drill:

- Step 1: Choose a stock that piques my interest—this month, it’s ServiceNow.

- Step 2: Invest a cautious $100—enough to stay in the game but not enough to lose sleep.

- Step 3: Wait for the stock to double. (Cue deep breaths and channeling the patience of a Zen monk.)

- Step 4: Sell half to recover my initial investment.

- Step 5: Keep the remaining shares as “free stock,” which I hold forever and tell everyone about at parties.

This strategy is as simple as it is self-indulgent. When it works, I get to feel like a genius. When it doesn’t, I tell myself, “At least it was only $100.”

The Lesson: Buying the Dip Is an Art Form

In hindsight, this trade is a perfect example of why buying the dip is both an art and a science. I saw a stock that had been on a hot streak, watched it fall 12.85%, and thought, “This is my moment!”

But you know what? I’m still smiling. Because here’s the thing about being an opportunist: you don’t let a little setback get you down. You see the potential in every situation, even when the numbers don’t quite add up. And hey, at least I can say I own a piece of ServiceNow. Sure, it’s 0.1 shares, but it’s mine.

So here’s to all the opportunistic investors out there, the ones who see a 12.85% drop and think, “That’s not a crash—that’s a sale!” May we all continue to believe in the potential of great companies—and maybe, just maybe, time our trades a little better next time.

Until next time,

The Guy Who Bought 0.1 Shares of ServiceNow on the Dip (and Still Believes in It)

Leave a comment