Ah, December—a time for reflection, resolutions, and my monthly ritual of figuring out where to deploy my $1,500. This month, my sights are set on ASE Technology Holding (ASX), a company that packages and tests the semiconductors that power the world’s gadgets. It’s not flashy, it’s not trendy, but it’s the kind of company that quietly makes the tech world spin. And yes, I’m betting $100 on it immediately, as is tradition for any prospect.

Why ASE Technology?

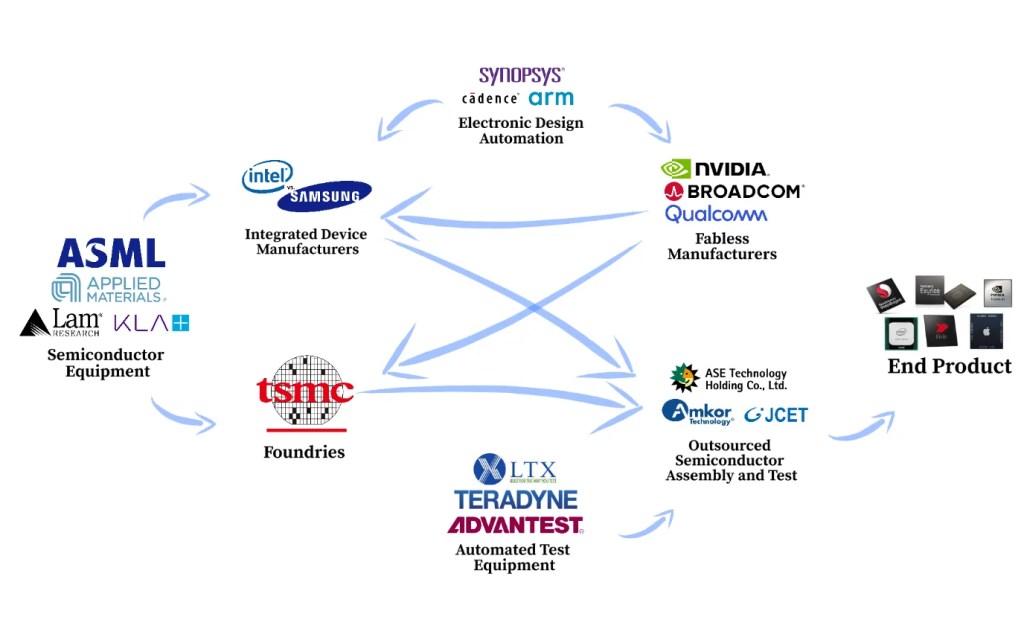

Here’s the short version: ASE is the largest Outsourced Semiconductor Assembly and Test (OSAT) provider on the planet, which is a fancy way of saying they package and test semiconductors for pretty much every major electronics company out there. If you’re using a device with a chip in it (spoiler: you are), there’s a good chance ASE had something to do with it.

But let’s break down why ASX has earned a spot in my portfolio this month:

1. The TSM – NVIDIA Connection

ASE is a major partner to Taiwan Semiconductor Manufacturing Company (TSM), which is itself the main supplier to NVIDIA (NVDA) and other AI-heavyweights. In other words, ASE is in the supply chain of the supply chain. If AI keeps booming, ASE’s business is likely to ride the wave.

2. Cheap Valuation

Trailing P/E of 20.49. For context:

- TSM is at 32.47.

- NVIDIA? A dizzying 52.11.

ASE may not be glamorous, but it’s comparatively looking like a bargain.

3. Quarterly Growth: Decent Enough

Quarterly revenue growth (YoY) is a modest 3.90%—hardly something to frame on the wall. But quarterly earnings growth (YoY) comes in at 10.10%, which is decidedly more “frame-worthy.” If my theories about the AI-driven demand for semiconductors are correct, those revenue numbers could get a lot more interesting in the future.

4. A Super Cheap Tech Play

Check out this Price/Sales ratio of 1.23. Compare that to:

- NVIDIA’s eye-watering 28.

- TSM’s still-expensive 13.

ASE isn’t just cheap—it’s bargain bin cheap, and I love a good deal.

5. Reasonable Debt Levels

ASE’s revenue for the trailing twelve months (TTM) clocks in at 590 billion, while debt stands at “just” 130 billion. In layman’s terms: they’re in solid financial shape. This isn’t one of those tech companies bleeding cash and praying for miracles.

6. Dividends

Forward annual dividend yield of 3.08%. It’s not exactly “buy a yacht” money, but I’ll never say no to some passive income.

What Does ASE Actually Do?

ASE isn’t just one of the biggest players in semiconductor assembly and testing—they’re also a pioneer in cutting-edge packaging technologies like:

- Fan-Out Wafer-Level Packaging (FO-WLP):

This enables ultra-thin, high-density packages for mobile devices. Translation: your smartphone gets smaller and faster. - Wafer-Level Chip-Scale Packaging (WL-CSP):

The tiniest chip packages out there, perfect for portable gadgets. - Flip Chip:

A method of flipping chips (literally) to connect them efficiently. The market for this tech is booming, driven by mobile devices, servers, and even smart TVs. - 2.5D and 3D Packaging:

These technologies enable high-performance chips for everything from gaming GPUs to network switches. ASE was a pioneer in 2.5D tech, working with AMD on innovations for extreme gaming. - System in Package (SiP):

A way to cram multiple ICs into a single package, powering wearables, IoT devices, and more.

Why Now?

There’s a growing demand for smaller, faster, and more efficient chips in everything from AI supercomputers to wearables to IoT devices. ASE is perfectly positioned to benefit from these trends, thanks to their leadership in semiconductor assembly and testing.

And let’s not forget: ASE’s partnership with TSM and their proximity to companies like NVIDIA means they’re tied to the AI boom without the frothy valuations that usually come with it.

My Strategy

As always, my goal is to transform this investment into free shares using my trusty Free Stock Strategy. Here’s the plan:

- Invest $100 immediately (minimum bet).

- Add the remaining $1,400 to my ASX position (if i don’t find anything better by December.

- Wait for the stock price to rise at least 40%.

- Sell just enough shares to recover my initial investment.

- Keep the rest of the shares as “free stock,” which I hold forever.

It’s not glamorous, but it works. When done right, this strategy feels like a financial magic trick—though one with a lot of waiting involved.

Final Thoughts

ASE Technology Holding isn’t the flashiest pick, but it’s a solid bet on the growing semiconductor market. With its cheap valuation, strong partnerships, and leadership in packaging tech, it’s poised to benefit from some of the biggest trends in tech today.

Will this investment turn into free ASX shares down the line? Only time will tell. For now, I’m cautiously optimistic—and fully prepared to act smug if my theories turn out to be right.

What do you think? Is ASE a sleeper hit or just another boring semiconductor stock? Let me know in the comments. And if you’ve got a more exciting December pick, I’m all ears (and slightly jealous).

Leave a comment