Bullet Points for Key Numbers

- Forward P/E Ratio: 5.24 (very reasonable).

- Price/Sales: 0.18 (cheap).

- Price/Book: 0.87 (undervalued).

- Dividend Yield: 10.92% (yes, really).

- Quarterly Revenue Growth (YoY): -7.50% (ouch).

My $100 Bet: Because It’s Almost Nothing

To be clear, $100 is not a significant investment for me—more like a curiosity budget. It’s a token amount to explore the potential upside without committing serious funds.

Xerox isn’t a candidate for my usual $1,500 monthly trades; the company’s negatives (declining growth and intense competition) are too risky for that. Instead, this is a calculated attempt to align with my “Double Up Free Stock Strategy”—a method where I aim to double my money, sell half, and ride the rest for free.

Why Xerox?

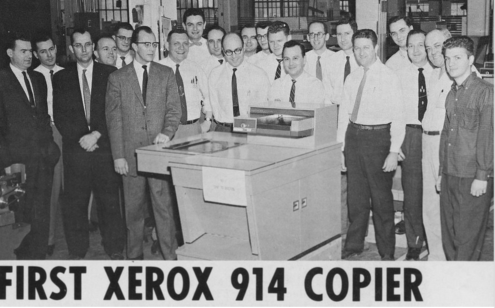

- Boomer Nostalgia: I remember the days when Xerox copy machines ruled the office landscape, doubling as social hubs and corporate status symbols. Fast forward to today, and Xerox is a shadow of its former glory. But maybe there’s still a spark in the ashes?

- Dividend Appeal: A 10.92% yield is hard to ignore. Even if the company limps along, those dividends might justify holding the stock for a while.

- Valuation Looks Decent (on Paper): With a forward P/E ratio of 5.24 and a price-to-book ratio below 1, the stock looks cheap—though there’s often a reason for that.

My Plan

- Hold until (if) the stock doubles.

- Sell half to recoup my original $100.

- Keep the remaining shares as my “free stock.”

Let’s see what’s next

Xerox feels like a dinosaur in the tech age, fighting off titans like Samsung and HP. I can’t ignore the revenue decline, and let’s be honest—who even prints anymore? Still, there’s a slim chance the company reinvents itself or finds stability, making this gamble mildly intriguing.

Imagine how good it would be if it went back to its old glory!

This isn’t about serious returns; it’s about testing a strategy on a company with a mix of risk, nostalgia, and a faint glimmer of hope. And hey, if it works, maybe I’ll use the dividends to buy a coffee in 2050.

Leave a comment