On 01/27/2023, I purchased 25 shares of NU at $4.338 each, amounting to ($108.45).

Subsequently, on 11/14/2023, I sold 13 NU shares at $8.831 each, generating a total of $114.79 in proceeds.

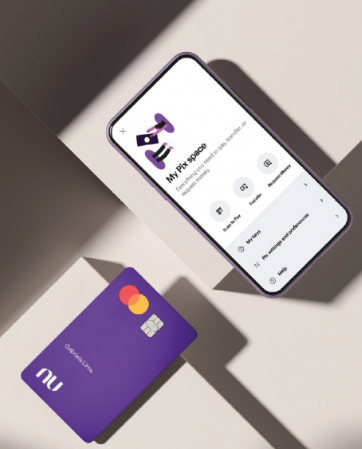

Consequently, I now hold 12 NU free shares without any cost, accompanied by a $ 6 profit. NU stands out as a rapidly growing player in the online banking sector, backed by the endorsement of Warren Buffett and boasting an impressive Quarterly Revenue Growth (yoy) of 106.10%, along with reasonable profitability metrics:

- Trailing P/E: 114.92

- Forward P/E: 25.45

These factors underscore NU’s potential for sustained growth, making me happy to retain the 12 free NU shares in my portfolio. Why should I sell them? They’re free!

Leave a comment