Hard (bad) facts:

- On Friday, 23 Mar 2012 Apple shares lost 9% of their value in seconds, due to some market “error” called “Flash Crash”.

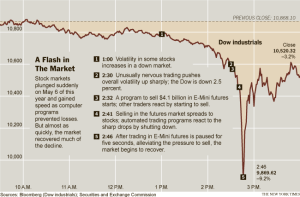

- the Flash Crash, also known as The Crash of 2:45, was a United States stock market crash on May 6, 2010 in which the Dow Jones Industrial Average plunged about 1000 points—or about nine percent—only to recover those losses within minutes.

Now I imagine myself having put a stop loss that is met in seconds, or I imagine putting a sell order at market price. I would have sold 9% under market price. Then I’d have started sending fire emails to my stock broker. I’d also have writen a Blog Post about it. But my money would have gone down the flush.

What Can I do about it?

- No preset authomatic orders like “Stop” Orders

- No more selling or buying at “market”. From now on I’ll always set a limit for my trades

Source:

Leave a comment